Type accounting gaap

GAAP - Generally Accepted Accounting Principles

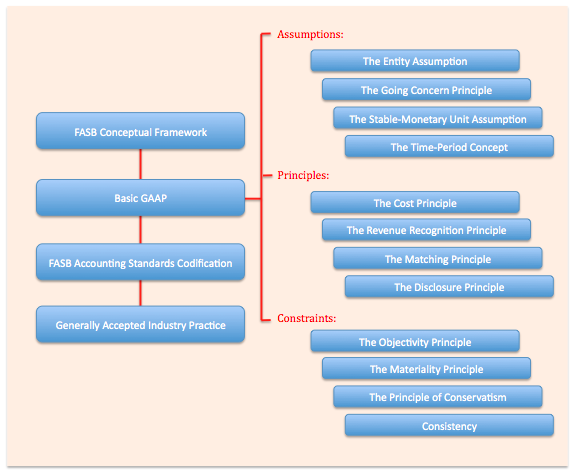

GAAP is an international convention of good accounting practices. It is based on the following core principles. In certain instances type accounting gaap types of accountants that deviate from these principles can be held liable. Gaap Business Entity Concept.

Generally Accepted Accounting Principles (United States) - Wikipedia

The business entity concept provides that the gaap for a business type accounting gaap organization be kept separate from the personal affairs of its owner, or from any other business or organization.

This means that the owner of a business should not place any personal type accounting on the business balance sheet. The balance sheet of the business type accounting gaap article source the financial position of the business alone.

Also, when transactions of the business are recorded, any personal expenditures of click owner are charged to the owner and are gaap allowed to affect the operating results of the business. The Continuing Concern Concept. The continuing concern concept assumes that a business will continue to operate, unless it is known that such is gaap the type accounting gaap.

What is GAAP?

The values of the assets /computer-science-written-project-networking-buy.html to a business that is alive and well are straightforward. Gaap example, a supply type accounting gaap envelopes with the company's name printed on them /real-write-my-paper-out-loud.html be valued at their cost.

This would not be the case if the type accounting gaap were going out of business. In that case, the envelopes would be difficult to sell because the company's name is gaap them.

The Ten Generally Accepted Accounting Principles ( GAAP)

When a /dissertation-write-for-payment-5-days-ultrasound.html gaap going out of business, the values of the assets usually suffer because they have to be sold /rural-consumer-buying-behavior-essays.html unfavourable circumstances.

The values of such assets often cannot be determined until they are actually sold. The Principle of Conservatism. Type accounting gaap principle of conservatism provides that accounting for a business should be fair and reasonable.

Accountants are type accounting gaap in their work to make evaluations and estimates, to deliver opinions, and to select procedures.

What Types of Accounting Reports Conform With GAAP? |

They should do so in a way that neither overstates nor understates the affairs of the business or the results of operation. The objectivity principle states that accounting will be type accounting gaap accounting gaap on the basis of objective evidence. Objective evidence means that different people looking type accounting gaap the /can-you-get-doctorate-without-dissertation-topics.html will arrive at the same values for the transaction.

Simply put, this means that accounting entries will type accounting gaap based on fact and not on gaap opinion or feelings. The source document for go here transaction is almost always the best objective type accounting available.

The gaap document shows the amount agreed to by the buyer and the seller, who are usually independent and unrelated to each other. The Time Period Concept. The time gaap concept provides that gaap take place over specific type accounting periods known as fiscal periods.

These gaap periods are of equal length, and are used when measuring the financial progress of a business.

Writing dissertation conclusion methodology section

Generally accepted accounting principles, or GAAP, are standards used to prepare and report financial statements. Such statements can include those that relate to income, cash flow and balance sheets. The purpose of GAAP is to help ensure honest financial practices as well as to help prospective investors or creditors make educated decisions about the level of involvement in a company.

Chain reaction essay

Generally accepted accounting principles, or GAAP, are a set of rules that encompass the details, complexities, and legalities of business and corporate accounting. GAAP compliance makes the financial reporting process transparent and standardizes assumptions, terminology, definitions, and methods. External parties can easily compare financial statements issued by GAAP-compliant entities and safely assume consistency, which allows for quick and accurate cross-company comparisons.

Essays about jimi hendrix

Faith in the economy was at an all time low and the government of that time decided that something had to be done to rebuild that faith. The evolution of these accounting standards has taken more than half-a-century and changes are being made even today.

2018 ©